Under the tax code, no deduction can be claimed on your tax return for any contribution to a charitable organization of $250 or more unless the taxpayer substantiates the contribution with a contemporaneous written acknowledgment of the contribution by the donee organization. For donations of money, the donee’s written acknowledgment must state the amount contributed, indicate whether the organization provided any goods or services in consideration for the contribution, and if so, provide a description and good faith estimate of the value.

Under the tax code, no deduction can be claimed on your tax return for any contribution to a charitable organization of $250 or more unless the taxpayer substantiates the contribution with a contemporaneous written acknowledgment of the contribution by the donee organization. For donations of money, the donee’s written acknowledgment must state the amount contributed, indicate whether the organization provided any goods or services in consideration for the contribution, and if so, provide a description and good faith estimate of the value.

A written acknowledgment is contemporaneous if it is obtained by the taxpayer on or before the earlier of:

- The date the taxpayer files the original return for the year of the contribution, or

- The due date (including extensions) for filing the original return.

You can’t just rely on the charity to provide the correct documentation. Many organizations know the rules and are careful, but some are not. Obviously, the larger the contribution, the more care you should take.

Shortly after a contribution, most charities will follow up with a statement. Some organizations mail out their statements just after the end of the year. Large contributions may be acknowledged quickly.

After making a substantial contribution, set up a reminder to look for the acknowledgment. Then, make sure the amount listed is correct and the other requirements are met.

Here’s a synopsis of the most frequently encountered charitable donation rules:

Cash contributions. No matter how small the amount, you need:

- A canceled check, credit card statement or other banking record, or

- A receipt or other written documentation from the charity with the donee’s name, amount and date of contribution.

For contributions of $250 or more, you’ll need an acknowledgment from the charity (see below). The $5 bill you drop in the kettle during the holidays isn’t deductible unless you get a receipt.

Noncash donations under $250. For each donation, you must have a receipt or letter from the organization indicating the organization’s name, date and location of donation, and a description (no indication of value required) of the property donated.

Many charities are lax with the rules. Make up a detailed list of items before contributing (don’t just write “five bags”). If that’s impractical, for example in the case of a clothing drop box, you may be able to satisfy the requirement with a reliable written record.

Contributions of $250 or more. For these donations, you must receive a contemporaneous written acknowledgment from the organization. It must include:

- The amount of cash and/or a description of the property contributed.

- Whether or not any goods or services were provided in return for the contribution and a good-faith estimate of the value of the goods or services.

- A statement that the only benefit you received was an intangible religious benefit, if that was the case.

Noncash contributions of more than $500. Property contributions of more than $500 require a description on IRS Form 8283 of your tax return of the donated property and certain other requirements. The $500 threshold is determined by totaling all similar items of property donated to one or more organizations and treating that as a single item.

Noncash contributions of more than $5,000. You need a qualified appraisal of the property donated. There are certain exceptions to this rule. One is for publicly traded securities for which market quotations are available on a securities market.

Vehicle contributions. If the vehicle is valued at more than $500, you need an IRS Form 1098-C or other contemporaneous written acknowledgment from the charity. The rules here can get complicated. Talk with your tax advisor before contributing.

Payroll deductions. Save the W-2, pay stubs or other documentation provided by your employer. You must also have a pledge card or other document prepared by, or for, the qualified organization that shows its name. If your employer withheld $250 or more from a single paycheck, you must also have an acknowledgment from the charity that you did not receive any goods or services in return for any contribution.

There are other rules dealing with conservation easements, contributions of appreciated property, facade easements, etc. And, while there are chances to save some significant tax dollars with these types of donations, there are plenty of traps. If you’re making a substantial contribution, or a series of contributions over time, check the rules carefully and consult with your tax advisor.

© 2017

Under the tax code, no deduction can be claimed on your tax return for any contribution to a charitable organization of $250 or more unless the taxpayer substantiates the contribution with a contemporaneous written acknowledgment of the contribution by the donee organization. For donations of money, the donee’s written acknowledgment must state the amount contributed, indicate whether the organization provided any goods or services in consideration for the contribution, and if so, provide a description and good faith estimate of the value.

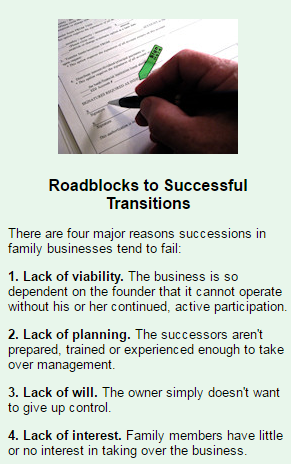

Under the tax code, no deduction can be claimed on your tax return for any contribution to a charitable organization of $250 or more unless the taxpayer substantiates the contribution with a contemporaneous written acknowledgment of the contribution by the donee organization. For donations of money, the donee’s written acknowledgment must state the amount contributed, indicate whether the organization provided any goods or services in consideration for the contribution, and if so, provide a description and good faith estimate of the value. When it comes time to transition your role as business owner to someone else, you’ll face many changes. One of them is becoming a mentor. As such, you’ll have to communicate clearly, show some patience and have a clear conception of what you want to accomplish before stepping down. Here are some tips on putting your successor in a position to succeed.

When it comes time to transition your role as business owner to someone else, you’ll face many changes. One of them is becoming a mentor. As such, you’ll have to communicate clearly, show some patience and have a clear conception of what you want to accomplish before stepping down. Here are some tips on putting your successor in a position to succeed.